Welcome to TeenVC

Content

Read on to start exploring the world of venture capital!

Content will be released every Tuesday and Thursday at 11am BST throughout April 2020, and will remain available after this time.

#1

Intro to TeenVC 👋

It’s great to have you on board! Click the button below to learn more about the programme and have a look at the titles to the right and below to see what you’ll be learning about.

#2

What is Venture Capital (VC)? 🧐

Venture Capital is key to the growth of many companies around the world. Here, we start with the foundations, from describing what a VC fund is and what they do, to explaining terms such as ‘portfolio’.

#3

What does the fundraising process involve?💸

What steps do investors take, from first learning about a company to giving them money?

#4

What do VCs look for in businesses? Product 🎮 (1/4)

Learn about the ways in which investors analyse the product or service a company sells.

#5

What do VCs look for in businesses? Market opportunity 🌐 (2/4)

How much potential demand is there for people wanting to use the company’s product or service?

#6

What do VCs look for in businesses? Team 👨👩👧👦(3/4)

What makes a great team? How can VCs analyse how effective the people behind the business will be in making it a success?

#7

What do VCs look for in businesses? Traction 🚀 (4/4)

It’s important for VCs to understand how much progress a company has made and how popular it is with customers before investing. But what does this involve exactly?

#8

How do VCs help businesses they invest in? 🤷🏾

Once a VC has invested in a company, what happens next? How do investors support their portfolio, aside from giving them money?

#9

#10

Careers in VC 👩🏾💻 (2/2)

Which skills do you need and how do you go about finding a job in VC?

The TeenVC Challenge 🌟

Put into practice what you’ve learnt over the last month with The TeenVC Challenge, for your chance to be selected for VC work experience later this year.

#1

TeenVC: An overview

Welcome to TeenVC, the free digital education platform where teenagers around the world can learn about Venture Capital and entrepreneurship, powered by London-based VC Augmentum Fintech.

At a time when schools around the world are closing and many teenagers are at home with more time on their hands, we thought we’d help break the boredom in an engaging, educational manner, helping teens from all walks of life learn about VC, tech and entrepreneurship. We had a number of educational initiatives planned over the next few months that we’ve needed to modify in light of COVID-19, including working with social mobility charity The Sutton Trust and a work experience week. We decided to launch TeenVC to continue the work digitally, educating young people on a career path rarely talked about in career education in schools and colleges.

Every Tuesday and Thursday throughout April 2020, a new content block made up of videos, articles and a quiz covering different elements of the VC industry will be released. Students will be able to watch videos from people across the industry share their thoughts and experiences in an easily-digestible way.

The initiative ends with “The TeenVC Challenge”, a deal-sourcing exercise that students can complete for their chance to be selected for an exclusive “VC Insights Experience” with Augmentum Fintech.

If you’d like to stay up to date via our email newsletter, you’ll find the sign-up at the bottom of this page. You can also follow us on Instagram and Twitter (@Teen_VC) and using #TeenVC. We’d love to hear how you’re getting on and if there’s anything else you’d like to see.

So, if you like what you’ve read so far and are keen to get stuck in, scroll down!

The TV show gives you an idea about how entrepreneurs pitch their companies and some of the questions an investor might ask to learn more and help them decide whether they want to invest (give them some of their money in exchange for some of the business). What do you think of their idea? Do you think people would buy and use it?

#2

What is Venture Capital (VC)? 🧐

It can be helpful to start by breaking down the name ‘Venture Capital’ into the two separate words:

‘Venture‘ is similar to ‘adventure’ which tells you that some sort of journey takes place. In the context of ‘Venture Capital’ this captures that businesses aim to progress along a journey from being early stage startup companies to becoming large, established businesses. Each startup which aims to grow into a big business can be thought of as an individual venture.

.

In the world of business and economics, ‘Capital‘, is money that businesses use in order to produce their products. Making and selling a product is how companies grow. Established companies recycle money from selling products into making more, but many startups need to get this money (capital) from a different source.

We are going to be focusing on Venture Capital here, but this isn’t the only option for early-stage companies by any means. Some founders “bootstrap” their business, i.e. use their own savings rather than getting money from elsewhere. See some examples of external funding sources below.

Click here to learn about other funding options:

- Savings from family and friends,

- Loans – borrowing money,

- Angel investors – people who invest their own money, usually into a number of different early-stage businesses,

- Venture capital trusts – similar to VC funds, but publicly listed, e.g. on the London Stock Exchange,

- Crowdfunding – raising money from a large number of people who each contribute a relatively small amount, usually online, through companies such as Seedrs,

- Grants – money you don’t have to give back, e.g. from the government,

…as well as some others. Learn more here.

VC funds tend to be willing to invest their money because the potential reward, if a startup is successful, is very high. They look for startups which have a lot of potential and in return for providing capital they take a share of ownership in the startup, e.g. 20%. “Equity” is another word for ownership which is used in the VC industry.

Putting the words back together we get to the following definition:

Venture Capital (VC) is capital (money) given to promising startups (ventures) to help them grow. VC is provided by investors (VC funds) in return for a share of ownership (equity) in the startup.

VC funds invest in a number of startups to build a so-called “portfolio” of investments. This helps the fund to spread risk and allows them to support a range of companies with different products.

For example, Augmentum Fintech has a current portfolio of 18 companies. Each of our portfolio companies uses technology in a unique way to solve a different problem in the finance industry. Some funds focus on a specific stage or industry – we will go into more detail on this later in the programme.

Watch the videos below to learn more!

Key Words

Below are a few commonly-used terms used in the VC and tech worlds.

If you come across another word you’d like us to explain, feel free to Tweet us @Teen_VC and we’ll add it to the list!

Startup

Investor

VC fund

VC Insights

Hear from people across the VC and wider startup ecosystem

Tom Bacon – Venture Associate, Founders Factory

Test your knowledge

Think you’ve got this? Test your knowledge by completing this quiz

We hope you’ve enjoyed your introduction to VC so far and would love to hear how you’re getting on! Tweet us @Teen_VC or email [email protected], and sign up to our newsletter to be notified when the next topic is released (scroll down to see the registration link).

#3

What does the fundraising process involve? 💸

As we’ve learnt, fundraising via VC is an important part of many entrepreneurial journeys, particularly if they want to grow quickly. The money can be used for anything in their business, from product development and team salaries to marketing and office supplies. But what exactly does the process involve? Let’s take a look at the main steps to get a better idea:

Stage 1 - Finding startups/investors

Stage 2 - Introductory meeting

The first meeting is a chance for the entrepreneur to showcase their startup. They will talk through their business plan, what makes their product/service different, how big the “market opportunity” is (we’ll go into more detail on this later in the course), who’s on their team, how much they’re looking to raise and what they plan to do with the money. A Founder might use a presentation, called a “pitch deck”, to help explain their business. A pitch deck is a great way to first engage potential investors as it quickly provides them with an overview of the business, and they can use this for meetings with different investors. Founders will usually meet with lots of different VCs before each side narrows down whether it’s worth continuing with the process. Generally, the money a startup will raise in a particular round will come from a number of different VCs.

If you scroll down, you’ll find some examples of pitch decks from well-known companies.

Stage 3 - Due diligence

As we saw in the last content block, investing in early-stage companies is risky. The due diligence process allows VCs to identify the key risks associated with the potential investment. The process involves asking and answering a series of questions to evaluate the business and legal aspects of the opportunity. This will take the form of several meetings, reference calls and digging into the financials of the business, for example using Excel. VCs like “scalability”, meaning the ability for a business to grow without increasing costs too much. This is why VCs often like investing in technology and software that can be distributed easily.

Stage 4 - Investment Committee

This is a big decision for both sides of the table. On the startup’s side, the Founders will think carefully about whether they would like to take investment from this particular VC – it’s a relationship that will last a number of years so it’s important for both investors and startup teams to decide whether or not it’s a good fit at this time. Taking money from a VC will often involve giving up a degree of control over certain things (e.g. the ability to raise debt, or to change the business plan), so it’s important that they trust them and are aligned on their vision.

On the VC’s side, the “Investment Committee”, which is made up of the senior Partners of the VC, will make the final decision. To reach a decision, they discuss various aspects of what was uncovered in the due diligence process and whether they agree the company will be a good fit for their portfolio.

Stage 5 - Close

Funding rounds

When a company raises money from investors (i.e. via the process above), it’s known as a “round”, and each round is given a name to help identify it. The first round a newly-launched company tends to complete is what’s known as a Pre-seed and/or Seed round (think of it like planting the seed to help your business grow). After this, letters are used: Series A, then Series B, Series C etc.

The amount of money raised tends to increase over time, as the business will be bigger (selling more products, servicing more customers, more team members etc,), so there’s more they can spend money on.

Over the next few topics we’ll be going into more detail on what VCs look at when analysing a business, from their product to their team and the market opportunity.

Pitch Decks

Here are some examples of pitch decks from well-known companies.

Imagine you are an investor looking at them and you hadn’t heard of the company before. Would you invest? What questions would you have for their teams which would help you come to a decision?

Key Words

Below are a few commonly-used terms used in the VC and tech worlds.

If you come across another word you’d like us to explain, feel free to Tweet us @Teen_VC and we’ll add it to the list!

Pitch deck

Due diligence

Investment Committee (IC)

Test your knowledge

Think you’ve got this? Test your knowledge by completing this quiz

#4

What do VCs look for in businesses? Product 🎮

Delivering a great product is a crucial part of building a successful business. A product is what a business sells to its customers, and this can take the form of a physical or digital product (something a company makes) or a service (something a company does).

To assess the product of an early stage company there are a number of questions VC funds will try to answer.

In this post we will run through examples of these questions and use the language learning app Duolingo as an example of a strong product.

Click the titles below to learn more.

1 - What is the problem the business is trying to solve?

Ideally this will be a problem that customers consider important enough to seek a solution for.

Duolingo example: Lots of people want to be able to speak another language, but learning can be hard, time-consuming, expensive and tedious.

2 - How does the product solve it?

Ideally the product will greatly improve the experience of the person using it. The product must be good enough to lead lots of customers to change their behaviour and start to use it.

Duolingo Example: Duolingo addresses language learning challenges in a number of ways:

Duolingo Example: Duolingo addresses language learning challenges in a number of ways:

- Using repetition to make learning easier

- As an app it is easily accessible on the move and can be used for short or long periods of time

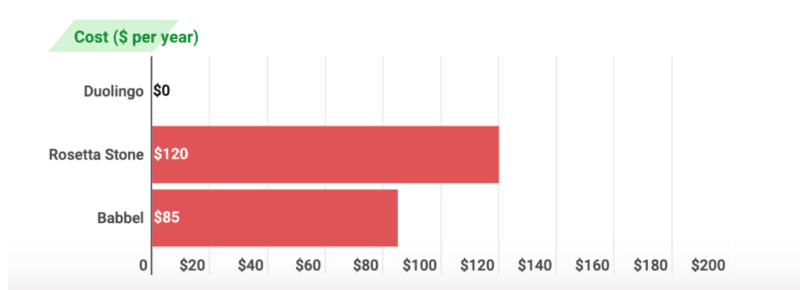

- The app is free to use

- Gamifying learning and using levels and rewards to promote engagement

3 - How strong are the competitors in this market?

Answering this question will involve comparing other products which attempt to solve the same problem.

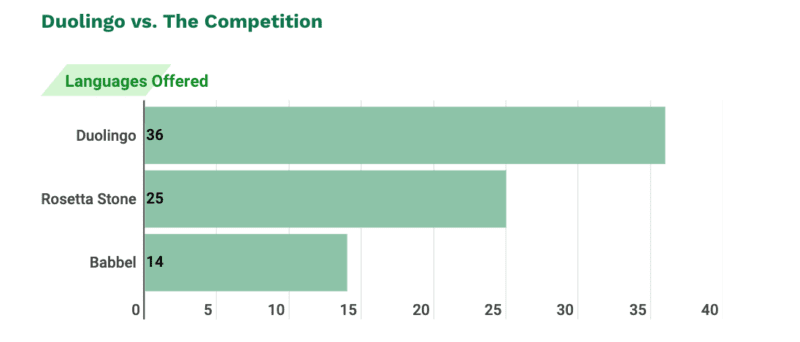

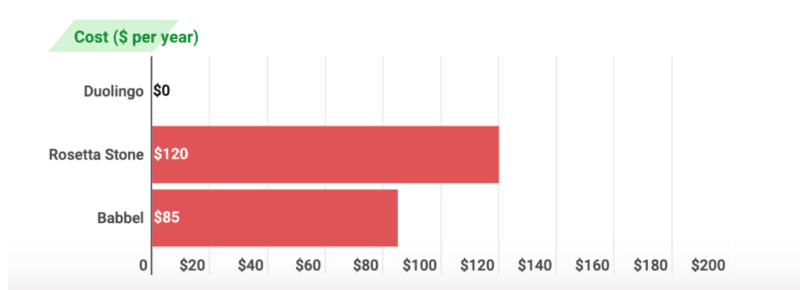

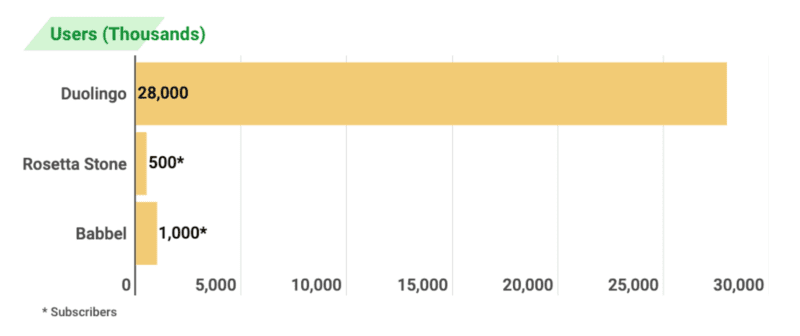

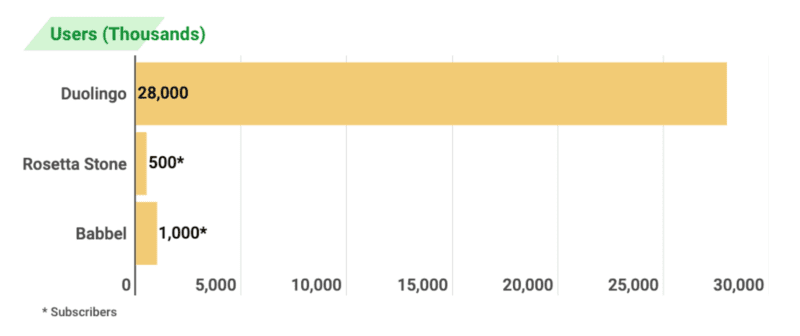

- Close competitors: Other digital language courses e.g. Babbel & Rosetta Stone

- Others: Books e.g. textbooks and dictionaries, YouTube videos, lessons from a teacher, moving to a country where the language is spoken, Google Translate…

It is important to think about the strengths and weaknesses of each of the alternative options available to customers. In the case of language learning many of the alternative solutions to Duolingo suffer with one or more of the issues outlined in (1) and the Duolingo app compares well due to the features outlined in (2).

Babbel and Rosetta stone represent the closest competitors to Duolingo. Important points of differentiation are cost and variety of languages on offer:

4 - Can the company protect the advantages it has over competitors?

Companies may try to protect the unique parts of their products with legal documents such as patents but in practice this is very hard to do.

Thinking about the future; imagine there was suddenly an app which allowed for entirely seamless communication between people speaking different languages. Overnight such a technology might reduce the number of people who want to learn another language. There is a risk that Duolingo could lose customers to this type of solution.

Investors in Duolingo would have considered this risk before making an investment but concluded that, although technology is constantly evolving, learning a language will remain important to many people for years to come.

More resources

Learn more about what makes a great product or service

Intro to Duolingo and learn how the business model allows the app to be free

As you’re watching this video, think about how future technologies could change the products we use today

Key Words

Below are a few commonly-used terms used in the VC and tech worlds.

If you come across another word you’d like us to explain, feel free to Tweet us @Teen_VC and we’ll add it to the list!

Market

Product/market fit

First-mover advantage

Test your knowledge

Think you’ve got this? Test your knowledge by completing this quiz

#5

What do VCs look for in businesses? Market opportunity 🌐

Market opportunity is important in understanding how big a startup could actually become if successful. As defined in the last content block, a market is all of the people interested in buying or selling a particular product or service within a specified area. VCs often look for a market that is big and stable enough over the long term, i.e. there are lots of opportunities for a startup to sell their product or service.

To assess the market opportunity of an early stage company there are a number of questions that investors will try to understand. In this post we will run through examples of these questions and use the ride-hailing company Uber as a case study.

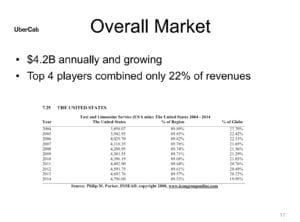

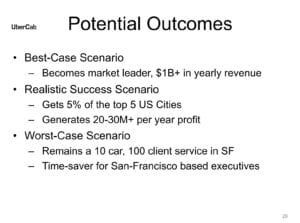

1 - How big is the market opportunity?

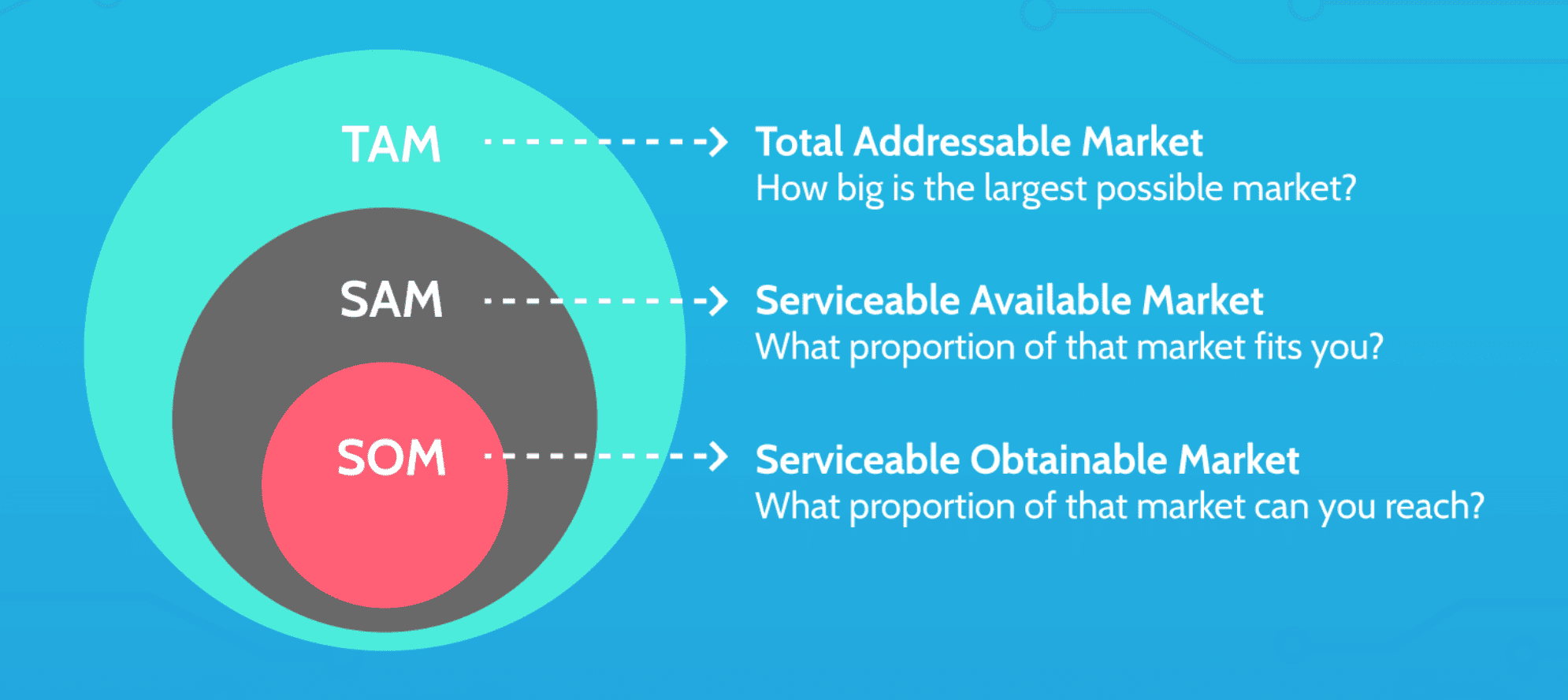

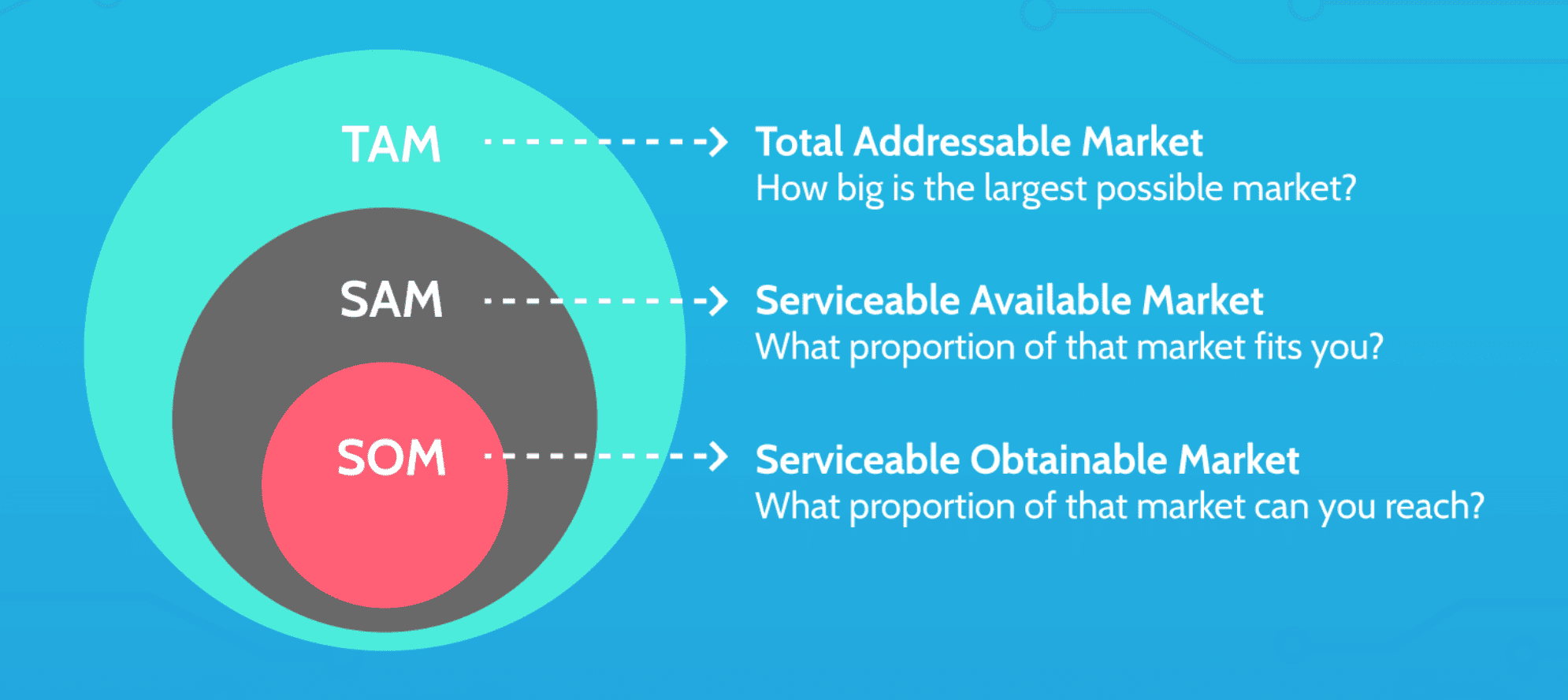

This question is asking how big a market for a startup will have to sell their product or service to. A good way to work out how big a market is to calculate its total size, then figure out what part of that the start-up could win. We’re going to use the TAM, SAM, SOM method to do this. Don’t worry, these acronyms might sound complex, but with the help of our Uber example we are going to break them down…

Image source: Process St

First let’s tackle the total market, AKA TAM (Total Addressable Market). The TAM is the total amount of people that might buy a startup’s product or service.

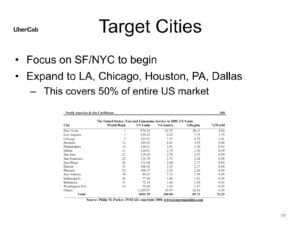

Next, let’s tackle the SAM (Serviceable Addressable Market). The SAM is the share of TAM that a start-up can actually reach with their product or service.

|

|

Lastly, we come to the SOM (Serviceable Obtainable Market). The SOM is the share of the SAM the startup can sell their product or service in right now, i.e. the immediate market opportunity.

|

|

2 - Is the market growing?

As well as a big market, you want one that’s growing. A market grows in size when there is increased demand for a startup’s product or service. Demand increases when customers find the product or service useful and well-priced, so buy more of it.

3 - Are there any other related markets?

Another way for a startup’s market opportunity to grow in size is if their product or service can be used in a different market. This occurs by taking existing products or services and launching them in other markets.

Now we’ve heard about how VCs approach understanding the market opportunity for a particular business.

Scroll down to find some videos, definitions and further reading.

More resources

Learn more about understanding a company’s market opportunity

TAM, SAM, SOM explained. In this video, the speaker uses the term “Total Available Market”, which is simply another way of saying “Total Addressable Market”

Investment Advisor Christina Mackay goes into more detail on market opportunity, including market size and growth rate, penetration and saturation

Key Words

Below are a few commonly-used terms used in the VC and tech worlds.

If you come across another word you’d like us to explain, feel free to Tweet us @Teen_VC and we’ll add it to the list!

Total Addressable Market (TAM)

The entire potential market

Serviceable Addressable Market (SAM)

The part of the TAM that a company can actually reach with their product or service

Serviceable Obtainable Market (SOM)

Share of SAM that a company can realistically sell their product or service into (based on things such as location and resources available)

Test your knowledge

Feeling confident? Test your new-found knowledge in this quiz ?

#5

What do VCs look for in businesses? Team 👨👩👧👦

The team running a startup is arguably just as important, if not more so, than the company’s product and market opportunity! Having a team that works well together and really understands how to grow their business is an essential building block for any successful company.

Investors will take time to get to know the team before making an investment in a startup as part of the due diligence process. They will do this over the course of several meetings, visits to the startup’s office and through talking to other people who know the team well e.g. former colleagues or advisors.

It is important that the team from the startup and the investors have a good working relationship since the investor will take on a supportive, advisory role after making an investment and will often join the startup’s Board of Directors. All companies are required to have a board who have a say in important company decisions.

There are a number of key roles at a startup, as described below. Early stage companies may not have people in all of these positions but will usually fill them over time.

Founder / Co-Founder

The individual(s) who create a company. If there are more than one they will be known as ‘Co-Founders’. The Founder(s) will typically hold another of the key roles at the startup in addition to being a founder, e.g. Co-Founder & CTO.

CTO (Chief Technology Officer) / Head of Engineering

The leader of the technology team at a company. They will typically have a background in software engineering and will build the product.

CRO (Chief Revenue Officer) / Head of Sales

Responsible for driving sales in a company. This person will oversee areas such as sales and pricing and will usually work closely with the marketing team.

CEO (Chief Executive Officer)

The leader of the company who makes important strategic decisions. The people in charge of the different departments at the startup will report to the CEO.

CFO (Chief Financial Officer)

The person in charge of the company’s finances. The CFO will oversee all the incoming and outgoing money and help build the business plan.

CMO (Chief Marketing Officer)

Responsible for people knowing about the company, with the aim of increasing the number of people buying the company’s product or service. Activities they are responsible for may include brand, advertising, social media, communications, PR (Public Relations) and market research.

COO (Chief Operating Officer)

Usually the second-in-command at a company. They are in charge of the day-to-day operations, systems and procedures of the company.

CPO (Chief Product Officer) / Head of Product

The person in charge of designing the product and creating the product roadmap of future features.

Head of People / HR

The person responsible for managing company culture, hiring and employee wellbeing. There may also be a Head of Talent – people with this job title tend to focus on recruitment.

Every team is different and each investor will have a slightly different opinion about what makes a team really stand out. Below you will find some questions that many investors will look to answer in order to build up an opinion of a startup’s team:

Who is on the team?

Potential investors will want to get to know the key members of the startup

What is motivating the team to build this company?

It is important that the team is passionate about the company they are building and the problem they are solving because building a company is challenging, with many ups and downs. The team will need to have high levels of motivation to succeed.

Do the team members have experience in the industry their company is in?

Potential investors will want to find out whether the team members have experience which will help them to build the startup. This might be from previous jobs or education.

E.g. If the team are building a social media app, the investor would be interested to know if the team members have experience working in social media, making apps and/or building a company.

What is special about this team and makes you believe they can be successful?

Even with a brilliant, motivated team in place, building a company is tough and there may be competitors, so potential investors will look for something that differentiates this team from others and makes them confident they will be the ones who can succeed. This will look different for different companies.

Who needs to be added to the team to allow the business to grow?

The investor will look at the “key hires” the startup will need to make as they continue to grow. They may even be able to help the startup find the right people for the roles.

Is this a team the investor will be happy to work with for many years ahead?

Investment into a startup kicks off a long-term relationship between a startup and a fund so it is important that both sides can work well together. A representative from the VC fund will typically join the startup’s board and take on an advisory role.

Now we’ve heard about what makes a great team. Scroll down to find some videos, definitions and further reading. Later in the course we will be explaining VC teams and careers.

More resources

Learn more about getting to know the people behind a business

A day in the life of a software CEO, with Sarah Nahm

Apple Co-Founder Steve Jobs discusses collaboration at Apple

Oliver Kicks is Head of Growth at RLC Ventures. Here, he talks about what gets him excited when meeting a startup team.

Simone Ishikawa is an angel investor and Director of Customer Success at OakNorth. Here, she talks about how important a good team is for her investment decisions.

Key Words

Below are a few commonly-used terms used in the VC and tech worlds.

If you come across another word you’d like us to explain, feel free to Tweet us @Teen_VC and we’ll add it to the list!

Founding team

The Founders and early employees of a company who will play a large role in building the business

Board of Directors

A group of advisors who make decisions in the interest of the shareholders (owners) and stakeholders (people with an interest) of a company

Professional reference

A recommendation from a person who can vouch for an individual’s experience and ability

Test your knowledge

Feeling confident? Test your new-found knowledge in this quiz ?

#7

What do VCs look for in businesses? Traction 🚀

Traction binds together the last few topics: product, team and market opportunity. Put simply, traction refers to the initial progress of a company and the momentum it builds as it grows.

Venture capital investors look for traction from a startup as proof that their product or service is used by people and there will be demand for it in the future. It also serves as proof that the team is performing well together and that the market opportunity exists.

Startups demonstrate traction in different ways through the use of “metrics”, which are measures of how the startup is performing. Example metrics include:

- Number of customers

- How much customers are paying to use the product or service

- How many customers keep using the product or service

Ultimately, the startup wants to show investors that there is demand for their product or service, and that this is growing.

How does a company know that their product or service is in demand? Well, the more people that use it, the higher traction they have. Imagine traction as a snowball that grows in size as it gains momentum: the more momentum it has, the larger it will grow.

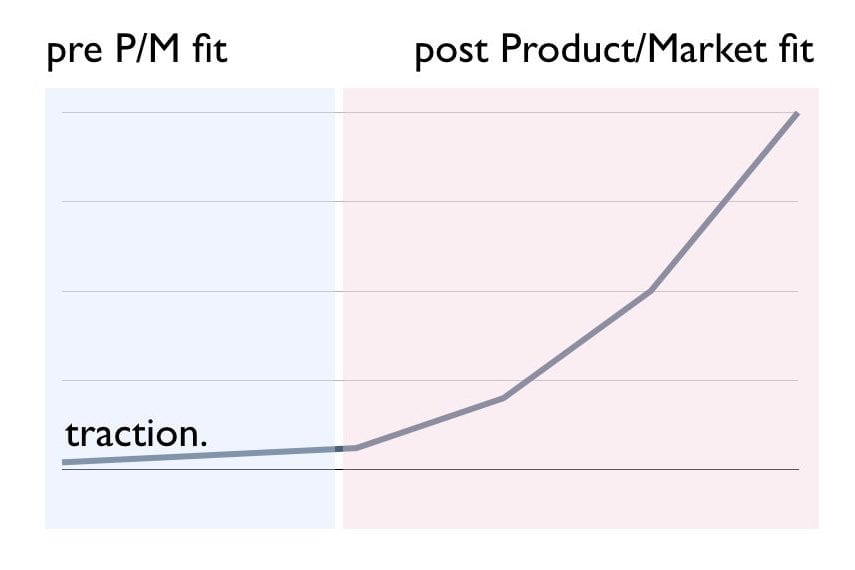

A good way to assess the traction of a startup is whether it has found “product/market fit”. When a startup has found product/market fit it shows that their product or service is addressing the needs of a large set of customers.

In the rest of this post we are going to unpack what exactly the term “product/market fit” is and how to measure it.

What is Product/Market Fit?

Product/market fit occurs when a product is well matched to meet the needs of a widespread set of customers. When customers find a product or service that satisfies their needs, they are more likely to use. To find product/market fit, startups will need to test their product or service with their customers to find the best version that serves their needs. The more a startup’s product or service is in-line with people and their needs, the greater demand for the product or service in the long term.

Source: Zero to Product/market fit by Andrew Chen

How do we measure Product/Market fit?

This isn’t an easy question, and there are no perfect answers – product/market fit will differ from company to company.

There are a few questions that can act as a useful starting point however, including:

How many customers use the startup over and over again?

Do the company’s customers keep coming back to use the product or service? If so, it means that it fills a real need in their life. Therefore, the product or service has matched the needs of a widespread set of customers.

Would customers care if the startup closed tomorrow?

This approach measures how many customers would be upset if they couldn’t have the startup’s product/service anymore.

A good test for this is to ask the start-up’s customers: “How would you feel if you could no longer use [product]?” The measure of success is if 40% or more respond “Very disappointed.”

Would the startup’s customers recommend their product or service to others?

This is another great way to measure if a company’s product or service has met the needs of its customers. If a customer thinks that a product or service is useful and would recommend it to a friend, it shows that they believe that it will meet the needs of a widespread set of people.

Below you’ll find some more resources to help learn about traction.

More resources

Learn more about traction and product/market fit

Getting customers in the business world is hard, but these entrepreneurs who have made it share how it really was for them in the early days of their businesses

Key Words

Below are a few commonly-used terms used in the VC and tech worlds.

If you come across another word you’d like us to explain, feel free to Tweet us @Teen_VC and we’ll add it to the list!

Product/market fit

When a product is well-matched to meet the needs of a widespread set of customers

Traction

Initial progress of a startup and the momentum it builds as it grows

Metric

A measure of how a company is performing

Test your knowledge

Feeling confident? Test your new-found knowledge in this quiz ?

#8

How do VCs help businesses they invest in? 🤷🏾

We’ve learnt about how VCs work and what investors look for in businesses when thinking about who to invest in, but what happens after an investment decision has been reached?

Investment decisions are not only about the money (“capital”). Building a business is tough, so when a startup team is thinking about who to take investment from, they will look at how potential investors will be able to help them (their “value-add”).

The support that VCs offer their portfolio companies varies from fund to fund, with some being more hands-on than others (early stage investors tending to get more involved in the day-to-day operations), but investors will always look to support rather than get in the way. As we learnt earlier in the course, some investors will take “board seats” in companies they invest in, meaning a place on their Board of Directors. They will meet at regular intervals and help make management decisions.

Every startup is different, and good VCs will adjust the support they offer in line with what a company needs at any particular time. There are a few main ways in which VCs tend to help companies they invest in:

Experience

Many VCs are made up of people with “operating experience” as well as investing experience, i.e. team members who have founded or worked in startups before, as well as having invested in lots. This experience means that investors can offer advice based on what they’ve seen work well in the past, or things to avoid, and act as a “sounding board”, bouncing ideas around and giving an outside perspective.

Network

VCs with great “networks” (i.e. the team knowing a lot of relevant people) can be useful for making introductions to potential customers, partners, suppliers, investors or people to recruit. This can help startup teams save a lot of time trying to find the right person to speak to.

Future fundraising

Investors can help with recommendations and introductions to other investors for future fundraising, i.e. if the company wants to go out and raise some more money.

Many VC funds have small teams whose job is specifically to help their portfolio companies with things such as marketing/PR opportunities, recruitment and events, complimenting the support offered by the Investment Team. There are various job titles for people in these departments, but many are called “Platform”, e.g. “Head of Platform” or “Platform Manager”. We will go into more detail on VC jobs in the next content block!

VC Example: Some VC funds have a particular area they focus on, for example Augmentum Fintech invests in fintech companies (“fintech” meaning “financial technology” – innovative companies disrupting the financial services sector, e.g. banking and payments). The Augmentum Fintech team is made up of people who have built and worked in successful fintech businesses in the past, who know lots of people in the finance and startup worlds and who can share their experiences with their portfolio startup teams.

More resources

Learn more about how VCs work with companies they invest in

Hear some of the Augmentum Fintech portfolio Founders and CEOs talk about what they look for in investors

(Note: this was recorded on 3rd March)

VCs discuss adding value beyond the money

Key Words

Below are a few commonly-used terms used in the VC and tech worlds.

If you come across another word you’d like us to explain, feel free to Tweet us @Teen_VC and we’ll add it to the list!

Board seat

A place on a company’s Board of Directors

Value-add

The ways in which a VC can help businesses they invest in

Network

All the people a particular person knows and interacts with

Test your knowledge

Feeling confident? Test your new-found knowledge in this quiz ?

#9

Careers in VC🧑🏻💻

Over the course so far, we’ve learnt that there are lots of different parts to working in VC which require different skills, from researching industries to finding and assessing companies, speaking to Founders, negotiating deal terms, working with startup teams to help them grow after an investment has been made, marketing and communicating with investors.

It’s very rare that working in venture capital is someone’s first job after school, college or university. While there are a lot of blogs, podcasts and books that you can read about entrepreneurship and venture capital (we give some examples below), most people in the industry say the best way to learn about how to spot and support high-potential startups is by working in or closely with fast-growing companies before moving into VC. It is for this reason that many people working in VC have had other careers first, in areas such as startups, consulting or banking (or a number of these!).

There isn’t one specific “way in” to a career in VC. The specific skills and experience you need to work in the industry will (like any industry) depend on the specific company, role and level you want to go in at. As a starting point, we’ll explain the types of jobs that exist in VC and in the next content block we’ll explore some key skills that will be helpful for a career in VC.

The Investment Team

The “Investment Team” is the group of people who find and decide which companies to invest in. People working in the Investment Team spend their days speaking with entrepreneurs, researching markets and companies, writing checks, taking board seats, and working with the Founders and companies they invest in. There is often overlap in the work that different team members do and it’s usually the case that anyone in the fund can suggest an exciting company that the Investment Team should think about investing in.

Below you will find some job titles commonly-found in VC Investment Teams:

Analyst

This is the most junior role in VC. Analysts usually have 2 or 3 years of work experience, often in banking, consulting or in a startup. Analysts tend to spend a lot of their time in the office doing research and analysis about companies and industries, although you may still find them out and about at networking events or “pitch days”, where startup Founders talk about their companies to people who might be interested in investing.

Associate

Associates tend to have a few more years of experience than an Analyst and are usually in their job for 2-3 years before being promoted (e.g. to Senior Associate). This job tends to involve a lot of time out of the office, going to lots of meetings and events with startup Founders and other investors. They are responsible for bringing relevant startups to the attention of the more senior members of the Investment Team (known as “deal-sourcing”) and can be considered “gate-keepers” in a way – despite not being the most senior members of the team, they have a lot of responsibility over which companies make it through the first stages.

Principal

Principals are senior members of the Investment Team and can be thought of as “Partners-in-training”. They help find exciting companies and meet with Founders, negotiate deal terms and work closely with leadership teams after the fund invests.

Partner

Partners are senior members of the Investment Team and have the greatest influence over investments that are made – they are the people who write the cheques. ✍️

People rising through the ranks in a VC may become a Junior Partner first. VC funds also have General Partners (GPs) and Managing Partners who run the fund, manage fundraising (i.e. raising money that the fund can then invest into startups) and vote on the deals the fund is thinking about doing. They will usually invest some of their own money into the fund. Some VCs also have part-time Venture Partners, who help to find companies to invest in and work closely with them once invested.

Note: Limited Partners (LPs) are people or companies who invest in a VC fund. They may be wealthy people, family offices, pension funds or insurance companies (“institutional investors”) amongst others.

Platform

As we touched on in the last content block, many VC funds have a small team (sometimes just one person) separate to the Investment Team, known as “Platform” or something similar, such as “Engagement”, “Community” or “Portfolio Services”, depending on what the people involved focus their time on. Their job is mainly to help their portfolio companies with things such as marketing/PR opportunities, recruitment and events, and they sometimes also work on supporting the VC fund itself, e.g. through marketing and investor communications. There are various job titles for people in these departments, but they include; “Head of Platform”, “Platform Manager”, “Head of Engagement”, “Head of Community” and “Head of Portfolio Services”.

This role is fairly new, with many VCs hiring their first people into these jobs only over the last 7 years, as VCs have been looking to find new ways to support the companies they invest in. Investment Teams are very busy so having Platform people can help make sure portfolio companies are well-supported. People working in Platform roles tend to have varied backgrounds, for example from marketing, recruitment, events and operations jobs in startups or larger, more-established companies, to having founded their own companies.

More resources

Scroll down to learn more about VC teams

Podcast: Keji Mustapha is Head of Network and Operations at Connect Ventures. Hear about her career journey, which includes studying law and working in a startup.

Thomas Bacon is an Associate at Founders Factory. Here, he talks about what he likes most about working in VC.

Key Words

Below are a few commonly-used terms used in the VC and tech worlds.

If you come across another word you’d like us to explain, feel free to Tweet us @Teen_VC and we’ll add it to the list!

Analyst

The most junior member of the Investment Team. Analysts spend most of their time researching companies and industries.

Investment Team

The group of people in a VC who are responsible for finding and deciding which companies to invest in

Platform

The department (1 or more people) responsible for a broad range of support and services for portfolio companies

#10

Careers in VC (2/2) 👩🏾💻

In the last content block we explored the roles typically found in venture capital funds. But how do people end up there? Below we dive into some tips from people working across the VC world.

Unlike what you might find in many large finance/consultancy/banking companies, there isn’t a set recruiting cycle or hiring calendar for VC. As with all job applications, it’s important to do your research. Look at VC websites and if possible, speak to people in the industry (or those running businesses who’ve taken investment from them) to form a picture of the kind of fund you’d ideally like to work in, e.g. one investing in early or later stage companies, or a particular type of company (e.g. tech or retail), the type of people you’d like to work with and “company culture” you’d thrive in.

It is a common misconception that you need to have a background in banking or finance and an MBA (Masters of Business Administration degree) to work in VC. While this can be incredibly helpful, it’s not essential to all roles. Every VC fund is different and will have their own hiring specifications, but here are some tips for pursuing a career in the industry:

Start your own business or work in a fast-growing startup

As we’ve learnt about previously, operating experience is a fantastic way of learning about building a company. It’s harder to judge the quality of a startup if you haven’t worked in one before. Starting your own business or working in at least one startup will also help you empathise (understand and share feelings) with people running companies you invest and hopefully give high quality advice, as you may have come across similar situations in the past. Lots of VC funds were started by people who started or were involved in running successful startups earlier in their career, for example Augmentum Fintech was started by Tim and Richard who had built a number of successful companies earlier in their careers, including Betfair (online gambling website) and Crussh (healthy food and smoothie bars).

Regardless of the type of job you do in a startup, from sales to marketing, finance to engineering, you’ll learn first-hand the work that goes into building a business and selling products.

Gaining experience in a specific industry can be helpful as you’ll develop specific knowledge about industry trends and what goes into building a great company, for example if you have worked in 3 different healthy food companies, you probably know a lot about the healthy food world. This means that if your fund is thinking about investing in this space, you’ll be able to share some relevant insights.

Learn to find and form opinions on exciting business ideas

Be curious! Learn about new innovative companies and start to form your own opinions on why they excite you, based on the topics we covered earlier in the course – team, market opportunity, product etc.

If you’re interested in a particular type of business e.g. gaming or beauty tech, learn about companies doing cool things in that area and see if you can spot any gaps. One way of doing this is by following entrepreneurs and VCs that you respect on Medium and Twitter.

Develop your analytical skills

Being analytical means being able to collect and analyse information, solve problems and make decisions well. Analytical skills are valuable in VC – if you want to work on an Investment Team you will probably be using these skills every day! Along with startup experience, experience in jobs such as consulting, banking, or finance/operations roles at large tech companies can be helpful for a VC career as you will be used to looking at and making sense of lots of information, then piecing it together in order to make decisions.

The TeenVC Challenge will be a useful starting point to put into practise some of the ideas you’ve learnt about so far.

Build your network

As a VC you will spend your time meeting and speaking with startup Founders, other investors and others working in the startup/tech industries. From sharing insights on exciting companies to discussing industry trends, building good relationships with lots of relevant people (your “network”) is an important part of a successful VC career.

While this will be easier once you start work than when you’re at school, you can still think about how you can meet people and learn about what they do. Do you have any family members or family friends who run their own businesses or work in startups/tech/investment? Asking them about what a typical day is like for them and what it’s like doing their job can be a good way of learning and you can start to form opinions around whether this sounds interesting.

Mentors can also be a great way of learning about a particular industry. There are some good (non-VC specific) programmes such as:

- Fledglink – a mobile app connecting young people from all backgrounds to career guidance, online workshops, virtual mentors and exciting work opportunities

- The Girls Network – empowering girls from the least advantaged communities by connecting them to a mentor and a network of professional female role models

- Mosaic Network by The Prince’s Trust – creating opportunities for young people in our most deprived communities through mentoring

Some schools offer mentoring programmes with ex-students, but you can also find one (or more) yourself, through meeting people at events or on LinkedIn. Note: if you are under 18, please make sure you get permission from your parents or guardians first.

Stand out from the crowd

Jobs in VC are highly sought-after, and like in all industries, it’s important to think about how you can stand out in the crowd of applications. What makes you unique?

Having a side-project outside of school/college/university/work can be a great way of exploring a passion of yours and can make you more memorable to potential employers. This could be anything from a blog to a meet-up, a podcast or a business.

Here are some examples of people who started side-projects before moving into VC:

- Sarah Noeckel (Investment Manager at Northzone) started Femstreet, a weekly newsletter on women in tech, entrepreneurship and diversity in venture capital. Read about Sarah’s learnings from this here

- Harry Stebbings (Founder of Stride.VC) started The Twenty Minute VC podcast

- Georgie Hazell (Head of Engagement at Augmentum Fintech) started women in tech networking group Elevate

Internships

Some VCs offer internships and there are a handful of great programmes which work with a number of different VC funds, such as Future VC by Diversity VC (which is running a series of virtual events this year instead of their usual in-person programme) and Included VC.

Scroll down to find some more resources on careers in VC, including podcasts, interviews and articles.

More resources

Scroll down to learn more about careers in VC

VC Career Journeys

Hear Augmentum Fintech Associate Freddie Evans talk about his route into VC and day-to-day in the fund on the Associated podcast.

Future VC is a 2-month paid internship and development programme, which enables talented people from all kinds of backgrounds to learn about VC. The programme is usually run in-person, with a remote option, but in 2020 the team are running a series of online talks and workshops instead.

Entrepreneurship for Teens

A podcast diving into the stories behind some of the world’s best known companies through interviews with founders.

Tenner is a National Enterprise Challenge helping students to develop an entrepreneurial mindset and prepare for the world of work as they attempt make as much profit as possible from £10

News on the European startup ecosystem, including company updates, funding rounds, venture capital deals, founder stories and how-tos. They also have a good email newsletter.

Entrepreneurs create business plans to help them consider all of the elements they are going to need for their new business to be a success. Learn more about them here

16 X 16 is an entrepreneurship programme for 12-16 year olds, run by Startup Sherpa, in which students learn how to bring their ideas to life through seven expeditions (virtual version available)

Apps for Good have developed a number of free creative technology courses, including “Design an App (Paper Based)”

Key Words

Below are a few commonly-used terms used in the VC and tech worlds.

If you come across another word you’d like us to explain, feel free to Tweet us @Teen_VC and we’ll add it to the list!

Operating experience

Experience working at, or running, a startup

Network

All the people a particular person knows and interacts with

Internship

A period of work experience offered by a company for people (usually students) to get some entry-level exposure to an industry. They can be between 1 week – 12 months long

We hope you have enjoyed learning about venture capital, from what makes a great business to the skills and experience required to work in the industry. Now, you can put into practice what you’ve learnt in The TeenVC Challenge! We will be selecting a number of people who enter to join us for work experience later in the year, at our offices in London (with a remote option available). We will also give feedback to everyone who submits a response.

We would like you to imagine you are on a VC Investment Team. Choose a startup you think is interesting and has high growth potential, and tell us about it using the questions below. We aren’t expecting you to know everything, but are looking for well thought-through answers. Pick a startup from the list below, or choose your own!

- Grover* – A subscription service for electronics such as phones and laptops

- Babylon – An app which lets you speak to a doctor using FaceTime

- Deliveroo – A restaurant food delivery app

- Onfido* – Identity verification using a phone or computer

- Drover – A subscription service for cars

- Gimi – A new bank aimed at Gen Z customers

- Glossier – A “direct to consumer” makeup brand

- Monese* – Mobile-first bank accounts available across Europe

*This is an Augmentum Fintech portfolio company but all entries will be assessed equally

When you’ve chosen a company, answer the following questions. You can submit your answers either in an online form, or in a video – more details below.

Questions:

Click here to open a printable version. |

Deadline: 31st May 2020

How to submit your answers:

You have two options when submitting your answers: you can either type your answers in an online form, or answer them in a video. Follow the links below to submit.

If you would like to type your answers in an online form, click the link above.

You won’t be able to save as you go along, so make sure you are ready to complete all sections before continuing! You may like to type out your answers somewhere else first (e.g. Word or Google Docs) then copy and paste into the answer boxes into the form afterwards.

If you would prefer to film your response, you can submit a video via the link above.

You may like to talk through your answers on screen, either in selfie-mode or with help from someone else, or talk through your answers off-screen if you’d prefer to not show your face. Feel free to get creative! You can use a phone, camera, laptop or computer – whatever you have available to you. We aren’t looking for professional editing skills here – the content and enthusiasm are the most important things!

If you have any questions, email [email protected] and the team will help you.

Important information:

- If you are under 18 you must have parent or guardian permission to take part in The TeenVC Challenge

- By completing The TeenVC Challenge you accept we will contact you by the email submitted. We will only email you in relation to TeenVC and won’t share your details with anyone else

- Everyone who submits a response to The TeenVC Challenge will be emailed by mid-June 2020 confirming whether or not they are being invited for work experience

- The TeenVC team will select a number of students to do work experience with Augmentum Fintech later in 2020 (either in person or remote). If you are successful we will contact you by email and you will need to provide evidence of parent or guardian permission in order to take part

- By completing The TeenVC Challenge you accept that we will store your response on file for up to 6 months

- We will only share your video via our marketing channels if we have express permission from you

- TeenVC is powered by Augmentum Fintech

Don't miss the next update!

(Don’t worry, we won’t spam you or let anyone else have your details!)

Powered by Augmentum Fintech

Augmentum invests in fast growing fintech businesses that are disrupting the financial services sector. It is the UK’s only publicly listed investment company focusing on the fintech sector in the UK and wider Europe, having launched on the main market of the London Stock Exchange in 2018. Augmentum gives businesses access to patient capital and support, unrestricted by conventional fund timelines and gives public markets investors access to a largely privately held investment sector during its main period of growth.

Learn more at www.augmentum.vc

Contact

[email protected]

5-23 Old Street, London, EC1V 9HL, UK